There can't be many rich fat people because poor physical health and financial health are driven by the same underlying psychological factors, according to Lamar Pierce, PhD, associate professor of strategy at Washington University in St. Louis, and PhD-candidate Timothy Gubler.

Of course, the argument is academic. Galileo once declared that, despite what sailors and the natural world knows, tides only happened once per day and the moon had no effect. He clearly needed to get out of the library. We know that the moon impacts the tides and we know that plenty of poor people are in fine physical health, so how did they come to such an odd bit of causalation?

They based their conclusion on the decision to contribute to a 401(k) retirement plan and correlated that to poor physical health indicators revealed during an employer-sponsored health examination in giant laundromats.

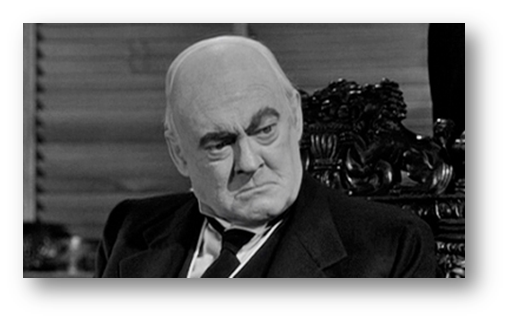

How to know Old Man Potter was a fictional character. He was rich and fat, which business scholars say psychologically doesn't add up. Credit: public domain.

You know you have left the real world when someone thinks that not contributing to a 401(k) is an indicator of health, rather than of being poor. But they conclude that not saving for retirement and chronic health problems are driven by the same time discounting preferences.

"We find that existing retirement contribution patterns and future health improvements are highly correlated," the study says. "Those who save for the future by contributing to a 401(k) improved abnormal health test results and poor health behaviors approximately 27 percent more than non-contributors."

Gubler and Pierce studied use personnel and health data from eight industrial laundry locations in multiple states. They found the previous decision of an employee to forego immediate income and contribute to a 401(k) retirement plan predicted whether he or she would respond positively to the revelation of poor physical health.

Gubler and Pierce wanted to compare 401(k) contributors and non-contributors on how much they were willing to change a health risk. Employees were given an initial health screening. Ninety-seven percent of them had at least one abnormal blood test and 25 percent had at least one severely abnormal finding.

They were told of the results, which were sent to the worker's personal physicians. Workers also were given information on risky health behaviors and anticipated future health risks.

The researchers followed the laundry workers for two years to see how they attempted to improve their health, and if those changes were tied to financial planning.

After controlling for differences in initial health, demographics and job type - a claim that has every statistics expert who reads Science 2.0 clawing at their eyes - the scholars declared that retirement savings and health improvement behaviors are highly correlated.

Those who had previously chosen to save for the future through 401(k) contributions improved their health significantly more than non-contributors, despite having few health differences prior to program implementation.

Comments