In New York State, under the Public Corporations law, so called "Authorities" or "Public Corporations" can be created that have the ability to raise capital, make autonomous decisions, and act independently fro the state government. Normally, these semi-public institutions are governed by small boards of political appointees and operate with little or no oversight. However, there are ways to make these public corporations return financial decision making power to the very people these decisions affect people.

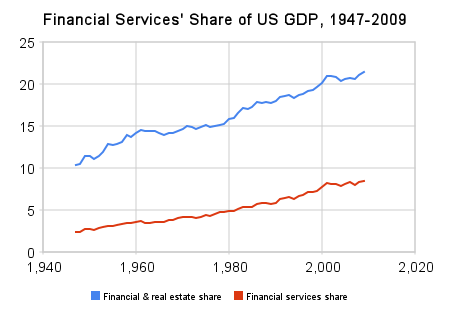

The financial crisis was only a reflection of the distorted nature of the American Economy, tooled primarily to provide services and financing for emerging businesses and technologies. But what do you finance, and what do you service when the so-called best and brightest have all taken jobs in the financial services and business services?

When the emerging technologies have emerged, and been emerged for the last 20 years.

When the emerging technologies have emerged, and been emerged for the last 20 years. Looking at the outstanding loans in the market, a laughable portion of the so-called capital utilized by finance goes towards financing the financial industry itself. It makes perfect sense. Why bother financing technical innovations,

(http://voices.washingtonpost.com) when financial innovations make so much more money! Because the financing of finance does not produce any additional real growth -- i.e. services which are valuable to the average consumer and the economy as a whole. Instead, of facilitating initiative and innovation, those traits which have differentiated and brought prosperity to the American economy, have been stymied by the corporatist system of economic production which has come to dominate the towering heights of the US economy.

The result is that people have learned to wait to take initiative -- wait until interest rates are low enough, wait until their housing prices have risen enough, wait until the stock market is high enough -- until their boss approves a project, or their friend comes through with a loan. Until the next sale, or the next stimulus, -- until the tax credit runs out, or the next tax credit comes. Until things get better. The very brave ones will just put it on their credit cards -- though the 10-15% APRs makes this an expensive means to acquire capital to launch new initiatives. And they make it particularly punishing for the small entrepreneur who has to put, not just his present livelihood on the line, but also his future livelihood, for the sake of initiatives which fail 90% of the time. Is this why we make it so punishing for the small entrepreneur? Contrast this to how easy we make it for the large financial corporation and its average high flying worker. We give that worker, billions, sometimes trillions of dollars at .25% interest rates. If he loses the money, he gets to keep all the money he made the previous quarter. If they really mess up, and lose more money than their entire institution can handle, then their interest rates are lowered, the government lends them all the money they lost, and they are allowed to borrow money, freshly printed for their sake, and park that money in treasury bills, to make profit for all the work they are doing -- all the economic activity they are performing. And yet, we pour large percentages of our financial power into so called businesses, while creating punishing credit regimes for those whose initiatives have traditionally driven the vast majority of job creation coming out of a recession.

Unfortunately, with the financial industry saddled with more than 100% of the GDP worth of debt, the financial industry will find it particularly difficult to issue loans, even given the Fed's record low interest rates. Banks will borrow, but they will not loan, since the little guy has no clear means to generate growth for the bank and returns for the bank in a shrinking economy -- an economy which the bank knows will shrink since the banks will not, and cannot finance further expansion, since it can't finance that expansion, etc, etc...

The result is a frozen economic system where profits flow disproportionately to banks, which borrow free money from the central bank and collect free interest by lending the borrowed money to the Treasury, further distorting our economy towards a command style centralized economy, and away from the system of free market enterprise, espoused by the very people undermining the foundations. Without a new means of monetary expansion, the Fed will lose its ability to guide the economy, while the US will lose its dominance in trade relations and finance. The US economy has been gutted from the top down, just like the former Soviet, Chinese, and Vietnamese economies in the 1980s. The only proven remedy is reform and decentralization of the economy.

(The Atlantic)

Our policy makers have excoriated the flaws of centralized planning for nearly a century, even persecuting those who displayed a penchant for interfering with the American system of Free-Enterprise. Yet, even as economic leaders celebrated the fall of the Centrally planned economies of the former Eastern Bloc, they were busy enacting policies which have led to an unprecedented centralization of economic decision making. The result of this shift and the demonstrated bankruptcy of the current system is the fact that the entire economy is frozen, transferring assets from "main street" to "wall street." For everyone else, a holding pattern on economic activity exists until someone with the financial authority approves new initiatives.

We speak of microfinance for struggling entrepreneurs in the third world, what about struggling households in the first? The internet has created massive opportunity for small businesses to spring for in the US, if only people could afford the $1000 dollars it would take to finance that first shipment of goods. Or the $4000 to pay for a website. Where does that money go? Right into the US economy. Entrenpreneurs are perhaps the only people who spend as much money as the typical US consumer. Entrepreneurs do not borrow money to sit on it or to lend it to people who are lending it the Treasury, which takes 2 years to spend the money it decides to spend. The entrepreneur spends their money as soon as they receive it, providing immediate economic activity, and the potential to create value creating jobs.

By chartering a jury style lending authority, New Yorkers can lower the cost of borrowing

for individuals and small businesses and help them escape the predatory lending environment that the federal government has failed to reform. Furthermore, investment income would be returned directly back to the community for further development goals, keeping development funds accountable and more economically efficient. Juries would be comprised of people who understand the neighborhood, and can make a strong judgment both about the moral character of the individual seeking a loan, as well as the viability the terms of his or her repayment.

Moral pressure to repay loans will further suppress default rates in these entities. Interest earned by successful communities can be reinvested, while a mandate to set interest rates equal to recovery rates would ensure that taxpayers are not stuck with the burden of communities that are unsuccessful. The current system of capital allocation is too inefficient with respect to gathering information about individuals in high risk communities .The closest analog to these banks would be a combination of microfinance and immigrant loan pools, the difference being that these banks would have access to interbank loans and federal funds, allowing the lender to make loans at very loan interest rates, currently with a base rate of .25% for short term fed funds loans. This means that on a 1 million dollar loan, the borrower, theoretically, would only pay 2500 dollars a year. Compare that to the Federally subsidized student loans, which current charge 6% or 60000 dollars per year, plus a 3% origination feed which would increase the cost of the cost of the loan by an addition $30000 right of the bat.

By creating experimental entities in partnership with the existing federal reserve system, communities may be revitalized within the existing banking system, without increasing taxes or laying out huge subsidies. This gives the state a way to leverage its funds for economic development without further straining the debt burden of the taxpayer

Funding Request Breakdown:

Funding Request: $120 Million.

First year: $10 million grant to Columbia University Earth Institute to create formalize institutional structure.

Second Year: $20 Million startup budget to hire staff, acquire physical infrastructure implement technologies and develop procedures, outreach to 64th District Community.

Third Year:$80 million Seed for establishment of Banking Reserves. $10 Million Operating Budget.

After Third Year, Scheme should be self sustaining.

An Analysis of the Efficiencies of a Jury Run Bank.

If we assume that the cost of evaluating a loan application may be written as below:

C= D + I + E + T + L (1).

Where the cost (C) of obtaining information on a given application is equal to (1).

D=Distance of the applicant from the loan officer in linear units.

I = Cost of acquiring information about applicant, ranging from standard demographic information, to more personal information such as credit scores etc.

E = Institutional Experience

T= The Technology of the Institution

L= The Labor Cost.

Let’s analyze each variable and the difference between a Jury run institution and a financial institution.

Distance Costs:

The distance variable is one frequently used in the economics of trade. It is used, in conjunction with network theory, to demonstrate how united territories are better suited for distribution than smaller, enclosed spaces and networks.

Jurors live within the district, which in the case of Manhattan, means a few square miles. Jurors can serve at night for a few hours at a time, as if attending a community board, but with immediate and real monetary consequences for people and the community. Individuals would be empowered and educated financially as well as about the lives of every day people.

Information costs:

Financial institutions do not share information about their borrowers, except through a credit score and credit report. However, this means that financial institutions will not make loans to borrowers who do not have a credit history. This can often lead to bad business decisions. Customized and individualized information is lost with the compression of individual credit histories into a single variable.

With a Jury, the amount of information known to the Juror about the loan applicant would be much higher than a typical banker. Proportionally, Jurors are much closer in distance (living distance, time spent near the applicant in social circles, etc) to those they are judging than a typical banker. Furthermore, Jurors will know personal information, which may be used to make a judgment on loan applications.

Naturally privacy issues are raised. However, like those running for public office, the private lives of those who seek to borrow public funds for entrepreneurial and consumer activities will come under scrutiny. Still those, who do not wish to be scrutinized can continue to borrow in the more robust private market.

Furthermore, Jurors can access the institutional record of a borrower and also have access to credit scores. Moderators will provide Jurors with expert advice on how to proceed in technical matters. And thus in theory, the Jury will have a much lower per unit cost of information, since they combine the technical expertise of moderators, and their own private information sources. Furthermore, the cost of the jury will likely be lower than the cost of a full time employee.

Experience of staff:

These will be similar, as moderators will carry the institutional experience which each of the fractured banks carry.

Technology of the Institution:

Will be similar in both institutions, as experts from the private sector would be employed in creating technological systems. Furthermore, the population will be trained in the use of technologies with which they normally would not have to interact.

Labor Cost:

Jurors should be able to decide many cases in a few hours of paid work. Juries would likely be inclined and encouraged to do home work over the course of their 2 day decision making process.

Full time Employees would be limited to expert consultants to the Juries, whom the Jurors could consult in cases of disagreement or technical questions.

Structure:

Juries would be comprised of a minimum of three citizens of the district randomly selected.

These 3 would have to all accept, or else a new selection of registered voting citizens would be selected.

This is done to maintain randomness of selection, though it does slightly skew the chances of granting to the application.

Juries will have limited total authority. For cases of large loans, applicants will have to petition multiple juries to grant them their application. It may be that their full petition will not be granted.

Moderators will work between groups of Jurors to provide expert information to the Jurors. Moderators hold institutional knowledge and thus Moderators will be assigned randomly assigned to prevent corruption.

Jury Hearings will be open to the public. And the public will be invited in each jury hearing that a case in being heard. Cases which have particular contention will be referred to the contentious juries where jurors would sit for longer trials

Unanimous votes:

Decisions must be made by unanimous vote. Thus Juries should be kept small.

Implementation:The choice of the 64th Assembly District in New York State for initial implementation of this scheme is particularly intriguing. The district includes financially astute individuals in the financial district. It includes Chinatown and its high concentration of cash based businesses. It also includes the Lower East Side, with its lower income community, an arts community, and religious communities. The range of projects would range widely. However, microfinance loans could be particularly useful in those communities. Transfer of financial knowledge from specialists to citizens would also occur, and opportunities to employ jurors as moderators could be available.

Jury based lending would encourage civic participation and community building, as members of the juries have real power to affect the lives of their neighbors by granting loans, and providing feedback as well as hearing about business ideas and the patterns which other households have in their expenditures.

Comments